Snappy, effortless service!!

No effort required!! Leave everything to us!!

Both in person and online support available!!

Tax Returns at

Competitive

Prices

¥150,000〜

No bookkeeping

necessary!!

Incredibly

affordable fees!!

Post-filing

audit support!!

Filing in as few as3Steps!!

When your tax return is

Giving you grief... stress...

almost due...

Leave it to the

No effort required!! Filing in as few as3 Steps!!

I need Financial Statements for bank evaluations

I want quick and easy tax filing services

I’m running out of time, but don’t know what to do

I want advice on how to save on my taxes

Trust in the experience gained from filing over50,000tax returns!!

Three Reasons to Choose

Reason #1

Responding to your needs promptly

We respond promptly once we have received your inquiry. We will keep you updated at every step, so you are always fully-informed.

Reason#2

Total support for minimizing taxes and documents required for bank evaluations.

Our experience and knowledge allows us to ensure you don’t pay a single yen in taxes more than you need to, and to know what the banks are looking for when creating documents for bank evaluations.

Reason#3

Providing complete follow up services even after filing.

Our certified tax accountants will stand by you for any inquiries received from the Tax Office after filing.

Start by calling or emailing us!

Try an initial consultation!

Hear from our happy and satisfied clients.

Client Testimonials

Freelance Writer

in her twenties, based in Tokyo

They’ve taught me so much about taxes and accounting.

They’ve been such a great help.

They’ve taught me so much about taxes and accounting, and always explain things in a way that even someone with no background in finances like me can understand. I’m looking forward to seeing where our partnership takes us!

Restaurateur

in his thirties, based in Hokkaido

Their fees are reasonably priced, and they’re always quick to respond.

I found them via the internet, thinking that it didn’t matter where my tax accountant was based, but that if I had to choose, I wanted one based in Tokyo.

I only deal with them once a year to file my taxes, but their fees are reasonably priced, and they’re always quick to respond.

What more is there to say? I’m very satisfied with their services.

From the metalworking industry

in his fifties, based in Kanagawa

They’re always prompt to assist with even loan and subsidy applications.

I was introduced to Seventh Sense Group by my bank when my tax accountant of ten years suddenly passed away and I was left in the lurch.

They’re always most helpful and prompt to assist with even loan and subsidy applications.

From the nursing industry

in her forties, based in Saitama

They handled the entire handover process from my old tax accountant right up to filing, smoothly and stress-free.

I was introduced to Seventh Sense Group in my darkest hour by a friend when the accountant I had worked with since I was a sole proprietor suddenly quit their firm just before the tax filing deadline.

They handled the entire handover process from my old tax accountant right up to filing, smoothly and stress-free. I’m so grateful. I look forward to continuing to work with them.

Flow of Service

No effort required!! Filing in as few as 3Steps!!

Start by calling or emailing us!

Try an initial consultation!

Services and Fees

Tax Return Support Plan

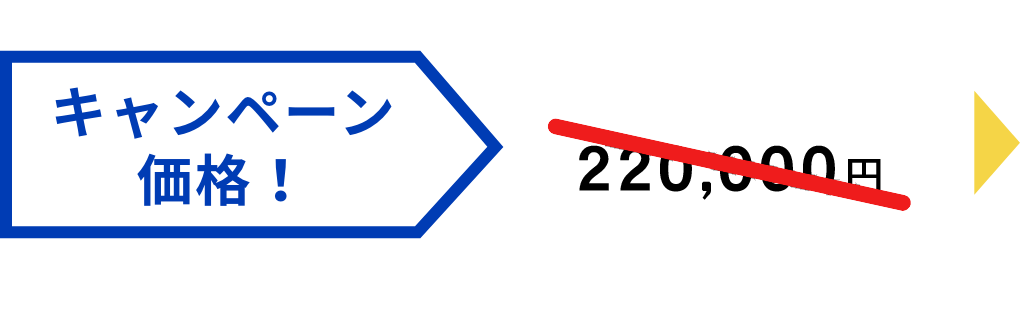

Limited Time Pricing !

¥150,000~

(inc. consumption tax)

■Services included

- ・Checking and correcting accounting data ※3

- ・Creating Financial Statements

- ・Creating Corporate Tax Returns

- ・Creating Local Corporate Tax Returns

- ・Verifying submission of Tax Return forms, Application Forms, and other required notifications

■Does this sound like you?

- ・I’ve had little to no sales since establishment

- ・I do not require monthly advisory services

- ・I only need a tax accountant to create and file my Tax Return

- ・Filing deadline is approaching, but I’ve made no progress

- ・I want to lower fees by doing what I can by myself

- ・I can do the booking myself, but I don’t know how to create Financial Statements or Tax Returns

※1. For businesses with annual turnover of less than one million Japanese yen, and data entry for fewer than 100 items.

Fees start at ¥250,000 for businesses with annual sales of over one million Japanese yen.

※2. Consumption Tax Returns incur a separate fee if required (fees start from ¥100,000~).

※3. Separate fee will be incurred if there is a significant volume of items to be checked and corrected.

Full-Service Plan

Limited Time Pricing !

¥250,000~

(inc. consumption tax)

+ ¥50 per data entry for all entries in excess of 600th entry

■Services included

- ・Data entry

- ・Creating Financial Statements

- ・Creating and filing Corporate Tax Returns

- ・Creating and filing Local Corporate Tax Returns

- ・Creating tax payment slips

- ・Creating General Ledger

■Does this sound like you?

- ・Accounting has never been my strong suit

- ・I’ve received letters from the Tax Office, but don’t know what to do

- ・I want to just send off all my receipts, and have someone else handle my Tax Return

- ・I haven’t filed my Tax Returns in years

※1. Additional fees will be incurred for cases where significant labor and time are required.

In certain circumstances, cases may be refused.

※2. Consumption Tax Returns incur a separate fee if required (fees start from ¥100,000~).

Speedy Full-Service Plan (Tax Returns in as Few as 10 Days)

Limited Time Pricing !

¥350,000~

(inc. consumption tax)

+ ¥50 per data entry for all entries in excess of 600th entry

■Services included

- ・Data entry

- ・Creating Financial Statements

- ・Creating and filing Corporate Tax Returns

- ・Creating and filing Local Corporate Tax Returns

- ・Creating tax payment slips

- ・Creating General Ledger

■Does this sound like you?

- ・Accounting has never been my strong suit

- ・I’ve received letters from the Tax Office, but don’t know what to do

- ・I want to just send off all my receipts, and have someone else handle my Tax Return

- ・I haven’t filed my Tax Returns in years

※1. Additional fees will be incurred for cases where significant labor and time are required.

In certain circumstances, cases may be refused.

※2. Consumption Tax Returns incur a separate fee if required (fees start from ¥100,000~).

※Audit support incurs a separate fee.

Frequently Asked Questions

- Where do I even begin?

- Leave it all to us! All you have to do is send us the documents necessary to complete your tax return.

It will depend on the state of your accounts and how documents and receipts are stored, but in most cases all you need to do is send us your bankbooks, receipts, invoices, and credit card statements.

After that, just relax as we handle the responsibility of filing and submitting your tax return. - This is my first Corporate Tax Return. I’m so stressed. What should I do?

- Rest assured! Everyone gets nervous filing their first tax return. However! We will explain the process every step of the way, so you can sit back and relax.

There’s nothing to worry about so long as all the supporting documentation is in order, so feel free to just toss everything our way and let us deal with it. - Do you accept last minute tax returns?

- Yes, of course! It’s not uncommon to have filing deadlines creep up on you despite

your best intentions to get started early. It will depend on the state of your accounts and how documents and receipts are stored, but we have systems in place that will allow us to get tax return done and filed in short order.

Please note that in certain circumstances, cases may be refused, and post-deadline filing may be necessary. Please contact us for further information. - My tax return is due in less than seven days. Can you help me file before it’s due?

- Contact us now! Some cases we have been able to complete and file within 2 days from time of inquiry.

Not all cases can be completed before the filing deadline, and it depends on the business' sales volume and state of accounting records, but we will do the utmost to get your tax return filed on time and help you avoid any possible tax penalties for post-deadline filing. - My tax return is overdue. Can you still help me?

- Yes, we can! We’ll start with a consultation so that we have a better idea of how we

can help you. Even if it seems likely that you will incur penalty tax for post-deadline filing, we will do what we can do to ensure that your financial burdens are minimized.

Please note that we cannot determine whether or not you will have to pay penalty tax without taking a look at your documents and holding a consultation, so please contact us as soon as possible. - I established my company several years ago, but have never filed a tax return.

Can you help me? - We'd like to begin by holding a consultation to get a better understanding of the business' past financial circumstances.

Please note that we will not accept fictitious transactions when creating financial statements for applications to the Direct Business Subsidy, Rent Subsidy, or other government supported programs for businesses affected by coronavirus.

For questions regarding the Direct Business Subsidy and Rent Subsidy, please refer to the relevant organizations.

Direct Business Subsidy

https://www.jizokuka-kyufu.jp/inquiry/Rent Subsidy

https://yachin-shien.go.jp/inquiry/ - I have never used accounting software to record my transactions. Can you help me?

- Not a problem! We will let you know what documents we need, such as sales data, bankbook copies, and receipts. All you need to do is to send them to us.

We will handle everything from data entry, creating the financial statements, all the way up to preparing and filing the tax returns. - What documents do I need to file my tax return?

- In general, the following documents are required (copies are fine; the originals are not required):

・Articles of Incorporation (for corporations)

・Company Registry (for corporations)

・Notifications filed with the Tax Office

・Social Insurance related documents

・Labor Insurance related documents

・Financial Statements, Tax Returns and accounting data for the past three fiscal years (not required for businesses newly established and in their first year)

・Cashbooks and receipts

・Bankbooks

・Sales related documents (sales book, invoices, delivery notes, etc.)

・Inventory related documents (inventory book, invoices, delivery notes, etc.)

・Payroll Ledger or other payroll records

・Credit card statements

・Relevant agreements (loan, real estate, leases, outsourcing, professional services, etc.)

・Loan repayment schedules

・Correspondence from the Tax Office/etc.

Please send us all books used (e.g. cash book, sales book, inventory book, etc.)

Please send us data in Excel format if available. - Can I do the books, and every year have you prepare my tax return only?

- Yes, you can! Many businesses do not require a monthly service contract due to low sales volume. There are also businesses that do their own bookkeeping using software such as Freee, MoneyForward, and Yayoi, and only engage tax accountants for filing purposes.

For such businesses, our fees are lowered to reflect the reduced amount of work required. Please do not hesitate to contact us for a consultation at any time.

We respond flexibly to your needs. We’re happy to help whether you decide to engage our services for tax return filing only on a yearly basis, or decide after several years that your business has reached the point where you require a monthly service contract. - Can you lower the price...?

- Please contact us! We charge competitive prices for our filing services.

We adjust our fees according to the volume of services required, so feel free to get in touch. - How do I pay for the Tax Return service?

- Full pre-payment is necessary for this service. Once the fee is received in full, creating the tax return will commence.

We can receive payment by bank transfer or even credit card, so for more details, please contact us. - I am working with another accountant. Is it possible to switch accountants right before filing?

- Yes, it’s possible. Feel free to contact us at any point during the fiscal year for a consultation if you are considering changing accountants.

If your current accountant also does your bookkeeping, the handover process will proceed more smoothly if we are able to receive said bookkeeping data. - Can I receive a copy of my tax return, and the related data?

- Yes, of course. Once completed, a hard copy version of the tax return is bound and mailed to you together with any documents received for filing purposes.

The general ledger will be provided on a CD-R disc.

Please note that the statutory retention period is seven years for tax returns and any related documentation. - Can I add a monthly service contract later on?

- Yes, you can! We recommend a monthly service contract for businesses that have grown to the point that their needs are not met by only engaging accounting services once a year to file their tax returns.

Please consult with us regarding the services you require, and we will prepare a quotation to meet your needs. - Does my tax return have to be filed by a tax accountant?

- In principle, responsibility for filing falls to the taxpayer. As such, it is not compulsory to have a tax accountant file your tax return.

Engaging a tax accountant is purely the delegation of work. However, only tax accountants may file on the behalf of others, or provide tax advice.

There are two major advantages in engaging a tax accountant to file your tax return. The first is lightening your workload by outsourcing burdensome tasks. The second is that having a professional handle the preparation of your financial statement and tax return increases their credibility when presenting them to tax authorities, financial institutions, and other similar organizations.

Although the filing of taxes is only a once-yearly event, engaging the services of a tax accountant may safeguard against any unforeseeable tax risks that may occur throughout the entire year. - What about questions from the Tax Office after my tax return has been filed?

- We can help! Tax returns filed by tax accountants are submitted together with Proxy Forms declaring that tax filing duties have been entrusted from the taxpayer to a third party. As such, all inquiries from the Tax Office will come directly to us. You don’t have to lift a finger!

Our tax accountants and staff are well-versed in dealing with the Tax Office, and are well- acquainted with external advisors such as Tax Office chiefs.

Relax, and leave dealing with the Tax Office to us.

Please note that attending audits, extensive post-filing communication with the Tax Office, and filing amended tax returns will incur an additional fee. In such an event, we will inform you of all the facts in advance. - My company is based in Hokkaido. Can you file my tax return?

- Yes, we can! We provide our services to all corners of Japan.

We provide our services over email, telephone, as well as web conferencing (Zoom, Skype, etc.). Distance is no barrier! Feel free to contact us at any time. - Can I get a consultation before I decide whether or not to engage your services?

- Of course! It’s common for our clients to be wracked with worries before getting the chance to meet with us, but leave our consultations feeling reassured. We believe part of being a good accountant is fostering open lines of communication. Reach out to us at any time.

Start by calling or emailing us!

Try an initial consultation!

About Us

- Company Name

- Seventh Sense Tax Services

- Representatives

- YoungEui Seu / Soichiro Imoto

- Business License

- Tokyo Certified Public Tax Accountants’ Association, License #1664

- Address

- Tokyo Akasaka Office

Akasaka Fukugen Bldg. 4F, 2-15-16 Akasaka, Minato-ku, Tokyo, Japan, 107-0052

Tokyo Ueno Office

Ueno Cube Executive 5F, 3-14-1 Ueno, Taito-ku, Tokyo, Japan 110-0005

Chiba Wakaba Office

Fukaya Bldg. #201, 2-23-22 Sakuragikita, Wakaba-ku, Chiba City, Chiba Prefecture, Japan, 264-0029 - Access

- Tokyo Akasaka Office

- Tokyo Metro Chiyoda Line: Akasaka Station (Exit 5a, 3 minute walk)

- Tokyo Metro Namboku Line: Tameike-Sanno Station (Exit 11, 5 minute walk)

- Tokyo Metro Ginza Line: Akasaka-Mitsuke Station (Exit 11, 11 minute walk)

Tokyo Ueno Office

- JR Yamanote and Keihin Tohoku Lines: Okachimachi Station (4 minute walk)

- Toei Oedo Line: Ueno-Okachimachi Station (3 minute walk)

- Tokyo Metro Ginza Line: Ueno-Hirokoji Station (3 minute walk)

- Tokyo Metro Ginza Line: Suehirocho Station (3 minute walk)

- Tokyo Metro Chiyoda Line: Yushima Station (4 minute walk)

- Tokyo Metro Hibiya Line: Naka-Okachimachi Station (4 minute walk)

Chiba Wakaba Office

- City Monorail Line #2: Sakuragi Station (4 minute walk) - Telephone

- 03-6426-5542

- Business Hours

- 9am~ 6pm. Closed weekends and holidays.

Accepting inquiries 24 / 7! Try an initial consultation!